Your Most Trusted Partner in Home Purchase Loans & Refinance Loans

Open Hours: Mon. - Fri., 9:00 a.m. - 6:00 p.m.

There are lots of options when it comes to mortgages. But two of these mortgage programs stand out from the rest due to their availability—the FHA and Conventional Loans.

Purchasing a home is a huge financial decision. So choosing the right mortgage is important in making sure that you don't become "house poor".

In this article, we're going to discuss the difference between FHA and conventional loans to help you find out which home loan is right for you.

An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). The FHA themselves are not the ones issuing the loan. They simply guarantee payment of the loan in case the borrower defaults.

Contrary to popular belief, an FHA loan is not just for first-time homebuyers. Although most of its borrowers are first-timers due to its lenient requirements, an FHA loan is also a good choice for those who are having trouble with their credit scores.

So what is a conventional loan and how does it differ from an FHA loan?

First up, a conventional loan is not insured by the government. Instead, it is guaranteed by two government-created enterprises—Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac).

Fannie Mae and Freddie Mac don't provide conventional loans. What they do is buy mortgages from the lenders, funding their ability to create more home loan programs. Fannie Mae and Freddie Mac then keep the loans they bought in their portfolio or package them into mortgage-backed securities (MBS) so they can be sold.

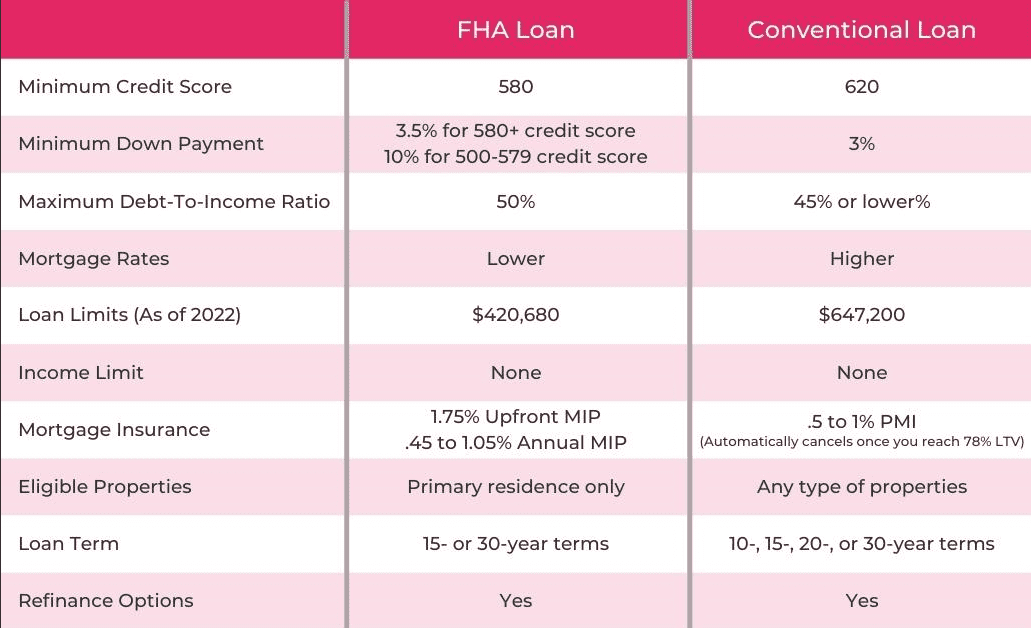

A credit score represents how likely a borrower will be to pay their debt. To lenders, having a higher credit score might mean that you are less risky and are more likely to pay your mortgage on time.

FHA loans require a minimum credit score of 580. Some lenders might allow you to have a 500 to 579 credit score. However, you would have to put in a 10% down payment.

Compared to FHA loans, conventional loans required a higher credit score of at least 620. Since conventional loans are not backed by the government, they pose a higher risk to lenders. That's why lenders offer this program to those they deem capable of repaying it.

One of the biggest factors most homebuyers prepare for is the down payment. Some take a long time to purchase a house because they think they need to put 20% of the home's purchase price. Although putting this down payment amount has its advantages, it's not always necessary.

With an FHA loan, the minimum down payment amount that you're going to pay greatly depends on your credit score. If you have a credit score of at least 580, you can put in as low as a 3.5% down payment. But if your credit score is between 500 to 579, you would have to give a 10% down payment.

On the other hand, the down payment required for a conventional loan is not affected by the borrower's credit score. For first-time homebuyers, the down payment requirement can go as low as 3%. For the second-time borrowers, a 5% down payment is required.

Your debt-to-income (DTI) ratio, represents the part of your monthly income that goes into paying off debts including student loans, car loans, and credit card payments. DTI is calculated by dividing your total monthly debt by your gross monthly income. Lenders refer to your DTI to determine how you will handle your monthly obligations and, at the same time, pay off the home loan you're planning to borrow.

When it comes to FHA loans, lenders have more leniency by allowing up to 50% DTI. This means that even if half of your monthly income goes into paying off debt, you'll still qualify for an FHA home loan.

The maximum DTI ratio required for a conventional loan will depend on the lender you're working with. Most lenders require a DTI of 45% or lower. While some would stretch the requirement up to 50%, borrowers would need compensating factors such as sufficient cash reserves or no unnecessary debts.

The mortgage rate you'll receive will depend on multiple factors. First, you need to realize that the average mortgage interest rate changes daily. Second, each mortgage lender has different standards for setting mortgage terms and rates. This is why it's important to shop for lenders and compare rates. And lastly, your credit score will affect your interest rates. Having a higher credit score might qualify you for better interest rates, and vice versa. Let's take a look at FHA vs conventional interest rates.

Compared to conventional loans, FHA loans have lower mortgage rates mainly because they are backed by a government agency. Moreover, FHA loan borrowers are often not in a hurry to pay off their mortgage compared to conventional borrowers. Because the lenders would provide their services for a long time, the FHA incentivizes them to offer lower rates.

FHA loan mortgage rates might be lower than conventional mortgage rates, but it's not the only factor that you should consider in choosing a home loan. The difference in the interest rates is just hair-thin. Additionally, with FHA loans, you will be paying for the MIP for the life of the loan.

The main reason for conventional loans having higher interest rates is the loan-level pricing adjustments (LLPA). LLPA is a risk-based fee that Fannie Mae and Freddie Mac apply to conventional home loan borrowers. This fee varies for every borrower and is based on certain loan traits such as credit scores and property type. In other words, the riskier a borrower is, the higher the interest rate is applied.

Loan limit refers to the maximum amount you are authorized to borrow in a certain area. It doesn't automatically mean that you can borrow up to the loan limit. The loan amount that lenders will approve will still depend on your creditworthiness and other loan factors.

Loan limits can change every year depending on the current average home price in the U.S. In 2022, the loan limits for both FHA and conventional loans have increased. This would give borrowers access to more homes in the market.

As of 2022, the FHA loans limit is $420,680. This applies to single-family homes in most areas. For high-cost areas, the limit can go up to $970,800 for a one-unit home.

Places like Alaska, Guam, Hawaii, and the Virgin Islands have different FHA loan limits. For single-family homes, the loan limit for these areas can go up to $1,456,200.

Fannie Mae and Freddie Mac can only buy mortgages that are within the limit set by the Federal Housing Finance Agency (FHFA). This is why conventional loans are also called conforming loans.

For 2022, the conforming loan limit for single-family homes in most areas is $647,200. For high-cost areas, including Alaska, Guam, Hawaii, and the Virgin Islands, the loan limit is $970,800.

If you need more than the conforming loan limit, a jumbo loan might be for you. However, jumbo loans often need higher credit scores and larger down payments.

Both FHA and Conventional loans don't have limits to how much income you can earn. However, you need to provide documentation that proves you have a stable source of income. Some of this documentation include:

Mortgage insurance is a policy meant to protect the lender in case the borrower is unable to make their monthly payments. Although both FHA and conventional loans have mortgage insurance, there's a stark difference on how it's required and for how long you'll have to pay.

With FHA loans, you'll be required to pay for the mortgage insurance premium (MIP) regardless of how much down payment you put in. FHA mortgage insurance premium involves two payments—upfront MIP and an annual MIP.

The upfront mortgage insurance premium, also known as the FHA funding fee, costs about 1.75% of your loan amount. For example, if you borrow $300,000, you'll have to pay $5,250 upfront. Upfront mortgage insurance premium can be a one-time payment upon closing. However, borrowers can choose to include this fee into their loan balance.

The annual MIP can range from .45% to 1.05% depending on the loan amount, term, and down payment. Usually, annual MIP can last for the whole life of the loan. But if you put a 10% down payment, you'll have to pay for MIP for just 11 years. The other way to get rid of MIP is to refinance to a conventional mortgage once you pay off 20% of your home's equity.

For conventional mortgages, lenders require private mortgage insurance if you put less than a 20% down payment.

Private mortgage insurance usually costs about .5% to 1% of your loan amount, which you'll have to pay every year. But unlike the FHA mortgage insurance premium, private mortgage insurance will automatically cancel once you reach 22% in home equity. You can also request to cancel it at 20% equity, but you would have to be current on your payments and have a good payment history. Additionally, your lender might request an appraisal to see if your loan balance isn't more than 80% of your home's current price.

You're not the only one that needs to qualify for a mortgage loan, the property that you're planning to buy should also be eligible. Regardless of the type of loan you apply for, the house you'll buy should be safe, secure, and sound.

When it comes to property eligibility, FHA loans have more restrictions compared to conventional loans. First up, FHA mortgages can only be applied to primary residences. The property should also undergo an appraisal to ensure that it meets FHA's standards which include:

The property needs to be marketable because it'll serve as collateral. In case the borrower is unable to pay the mortgage, the lender can take the property and sell it.

Conventional mortgages can be applied to just about any type of property including primary residence, second homes, or investment properties. Although an appraisal is also needed, it doesn't have to be as in-depth as the assessment for FHA loan properties. And even if you buy a fixer-upper, you still might qualify for a conventional loan.

However, if you want to take advantage of the 3% down payment, the property you're buying should be your primary residence. If you're buying a vacation home or investment property, you'll have to put in more down payment than just 3%.

The loan term often refers to the duration it takes to pay off a mortgage. With a long-term loan, you'll be paying more in interest but will be more likely to have a lower monthly payment. With a shorter loan term, you might be paying more in interest, but you'll own your home faster.

For FHA loans, the term can either be a 15-year or 30-year. Moreover, you can only have a fixed-rate mortgage. This means that the interest you'll be paying will stay the same for the life of the loan.

Conventional loans offer more choices when it comes to loan structures that you can choose from. You can also opt to have a fixed-rate mortgage or an adjustable-rate mortgage. An adjustable-rate mortgage means that the interest rate you'll be paying will fluctuate depending on the current market price of properties.

Both FHA and conventional mortgages offer refinance options often to get a better rate, lower the monthly payment, or tap into the home's equity. Before you refinance, always evaluate your current financial situation. If possible, consider refinancing only if you've exhausted any other possible solution.

Out-of-pocket expenses refer to costs that borrowers (and sometimes sellers) would have to pay with their own cash. This can include the down payment as well as the closing costs needed to process the loan.

The payment needed to close both FHA and conventional loans is about 2-5% of the loan amount. With an FHA loan, borrowers are allowed to have 100% of the down payment gifted by a relative, employer, or charitable organization. But with conventional loans, you'll be required to pay a portion of your down payment from your own cash reserves. Additionally, you can only receive down payment gifts from family members.

Both FHA and conventional loans have their own advantages and disadvantages. So choosing between an FHA loan or a conventional loan will depend on your financial situation and needs.

A mortgage broker is a licensed professional that can help with your loan application. Instead of you shopping around for lenders, a mortgage broker can do the grunt work for you. And with our wide range of connections to lenders, we can get you access to the best mortgage deals in town. Additionally, we can help you decide whether a conventional loan vs FHA loan is better for you or answer any questions you have about mortgages. Basically, a mortgage broker can make your loan process stress-free and more efficient.

Looking for amortgage broker in Tampa? Call Ebenezer Mortgage Solutions today at (813) 284 - 4027 so we can start working on your loan application.